More About Pacific Prime

Insurance coverage additionally helps cover prices associated with liability (lawful responsibility) for damage or injury created to a third event. Insurance coverage is a contract (policy) in which an insurance provider compensates another against losses from details contingencies or risks.

Investopedia/ Daniel Fishel Numerous insurance coverage kinds are readily available, and virtually any individual or organization can discover an insurance business going to guarantee themfor a cost. Common individual insurance coverage types are auto, wellness, home owners, and life insurance policy. Many individuals in the USA contend the very least one of these kinds of insurance, and auto insurance is needed by state law.

The 9-Second Trick For Pacific Prime

Finding the price that is best for you needs some research. The plan restriction is the maximum amount an insurance provider will spend for a protected loss under a policy. Optimums might be set per period (e.g., yearly or plan term), per loss or injury, or over the life of the policy, likewise recognized as the life time maximum.

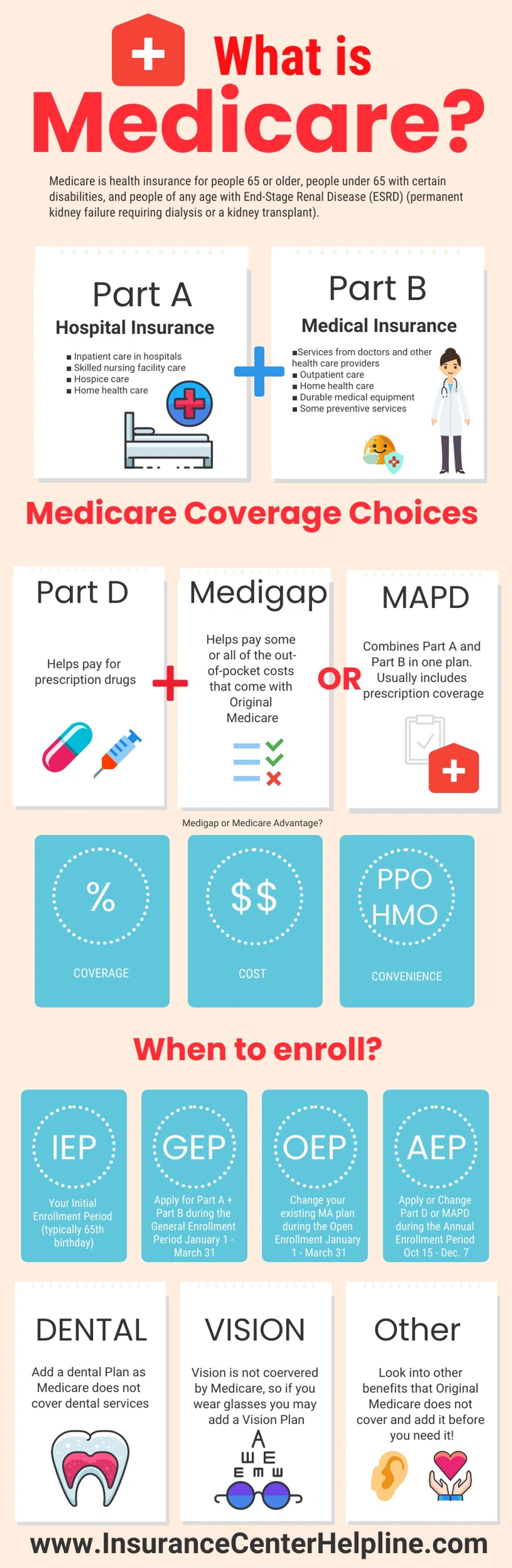

Policies with high deductibles are usually more economical because the high out-of-pocket cost normally results in fewer little claims. There are several sorts of insurance coverage. Allow's look at one of the most essential. Medical insurance aids covers regular and emergency treatment costs, commonly with the choice to include vision and dental solutions independently.

Lots of precautionary solutions might be covered for complimentary before these are satisfied. Health insurance may be acquired from an insurance company, an insurance coverage representative, the federal Wellness Insurance policy Industry, provided by a company, or federal Medicare and Medicaid insurance coverage.

Examine This Report about Pacific Prime

As opposed to paying of pocket for auto crashes and damages, individuals pay annual premiums to a car insurance provider. The business after that pays all group insurance plans or a lot of the covered expenses linked with an auto mishap or other automobile damages. If you have a leased lorry or borrowed cash to purchase a cars and truck, your loan provider or renting dealership will likely require you to carry automobile insurance coverage.

A life insurance coverage policy guarantees that the insurance firm pays a sum of cash to your recipients (such as a spouse or kids) if you die. There are 2 primary kinds of life insurance policy.

Irreversible life insurance policy covers your whole life as long as you proceed paying the costs. Travel insurance policy covers the costs and losses connected with traveling, including trip terminations or delays, coverage for emergency healthcare, injuries and evacuations, damaged luggage, rental cars, and rental homes. Nonetheless, even a few of the finest travel insurance policy business - https://pacificprime.godaddysites.com/f/pacific-prime-your-gateway-to-international-health-insurance do not cover cancellations or hold-ups as a result of weather, terrorism, or a pandemic. Insurance policy is a method to manage your monetary risks. When you get insurance policy, you acquire security against unanticipated financial losses.

6 Easy Facts About Pacific Prime Shown

There are many insurance policy kinds, some of the most common are life, wellness, house owners, and auto. The appropriate kind of insurance coverage for you will certainly rely on your objectives and monetary circumstance.

Have you ever had a moment while considering your insurance plan or purchasing insurance policy when you've believed, "What is insurance? And do I really need it?" You're not alone. Insurance can be a mysterious and puzzling point. How does insurance job? What are the advantages of insurance coverage? And exactly how do you discover the most effective insurance coverage for you? These prevail concerns, and fortunately, there are some easy-to-understand answers for them.

Suffering a loss without insurance can place you in a hard monetary circumstance. Insurance coverage is a vital economic tool.

Little Known Facts About Pacific Prime.

And sometimes, like car insurance coverage and workers' payment, you may be required by law to have insurance coverage in order to safeguard others - maternity insurance for expats. Learn about ourInsurance choices Insurance is basically an enormous nest egg shared by lots of individuals (called insurance policy holders) and handled by an insurance coverage provider. The insurance provider makes use of cash accumulated (called premium) from its policyholders and various other financial investments to pay for its procedures and to fulfill its promise to insurance holders when they submit a claim